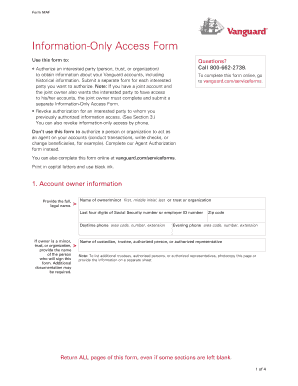

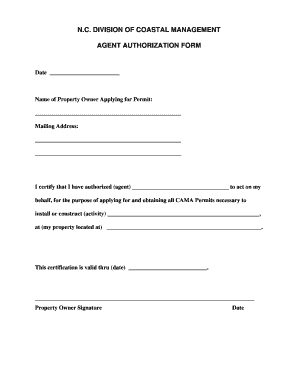

Get the free vanguard agent authorization form

Get, Create, Make and Sign

How to edit vanguard agent authorization form online

Video instructions and help with filling out and completing vanguard agent authorization form

Instructions and Help about vanguard full agent authorization form

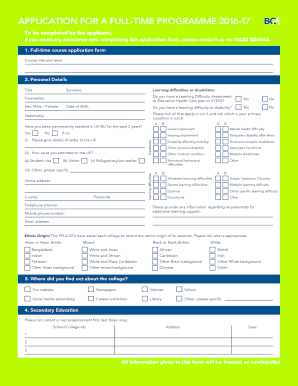

Hey guys, and thanks for stopping on in for today's video where I want to walk you through what I recommend in terms of investing in mutual funds for your retirement and essentially what I'm going to do is just walk you through and give you the rationale of what I do myself in terms of investing in Myra time right now I don't have a financial advisor and I definitely recommend it if you can avoid having the financial advisor it's going to benefit you in the long run if you can take control of your own retirement investing because if you don't have a financial advisor they're not taking out the expenses and fees on a yearly basis which is going to leave you a larger nest egg that can compound interest annually, and you're going to have a much larger nest egg by the time you get to retirement if you can avoid going the financial advisor route and if you're going to do this you're going to have a brokerage account yourself I'll link this article down in the video description it's the nerd wallet dot-com there summary of the nine best online stockbrokers for trading stock and me personally I have my retirement account through trade, but you can do some research if you want on all these different options again I'll link this nerd wallet article down in the video description if you're looking for different research material on what online broker that you might want to go with but in terms of the mutual fund that I recommend that you invest in for retirement are these balanced funds that we get from the Vanguard and the reason why I recommend the Vanguard is that they have extremely low expense ratios and essentially the lower expense ratio you can get the better off you're going to be at the end of the day because this is basically the money that the mutual fund takes out of your account on a yearly basis basically the cost to manage the fund and these lower managed funds the ones that use ETFs they're going to have much lower expense ratios in the Vanguard is pretty much the gold standard in most situations in terms of having extremely low expense ratios and very well-balanced and diversified assets within these funds, so you can see here they have all these different target retirement dates, and they're spaced 5 years apart so for instance if your target retirement is 20 65 or 2015 it's going to be a very different mix in terms of risk exposure and as this goes through the years it's going to automatically adjust the risk exposure as you get closer and closer to retirement, so I'm going to open up the target retirement 2015 in the target retirement twenty sixty-five, so you can see the difference in terms of the risk exposure of these well diversified retirement mutual funds so starting off here this is the 2015 retirement fund, so it's going to be a lot more secure and safer investments, and we can see the number one holding is the United States bond market fund at thirty-four percent of the holdings and then below that you have the United States...

Fill vanguard agent authorization form pdf : Try Risk Free

People Also Ask about vanguard agent authorization form

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your vanguard agent authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.